Most likely no, especially if you’re balancing the need for incentivizing seller performance with guaranteeing seller investments in infrastructure and equipment – but before deciding any approach, know the limitations as well as the advantages

AUTHORS – see bios at end of article

Dr. Andrew Jacopino, M.SC, MBA, PhD, Director, Ngamuru Advisory

Roger Chouinard, M.SC, MBA, Service Delivery Performance Manager, Future Aircrew Training (FAcT) Program, Canadian Department of National Defense

Jeremy Chenier, Supply Manager, Public Services and Procurement, Canada

Since Performance-Based Contracts (PBCs) were introduced in the mid-2000s, Award Term contracts have become common in long-term agreements to incentivize sellers by extending the contract terms for meeting or exceeding contract performance requirements.

However, this approach can get overly challenging when extensive upfront investments in infrastructure and equipment are involved (e.g. building plant vehicles, aircraft, etc.). The relatively short initial contract term of an Award Term contract may lead to high initial costs, forcing sellers to recover their investments over the short term of the contract.

To solve this conundrum, the Variable Term contracting approach was developed starting with the maximum contract term and then allowing the term to vary (to be adjusted) based on contract performance allowing sellers to amortize costs over a longer maximum contract term. This article explores how the Award Term contracts apply to high-investment, long-term contracts and reveals why the Variable Term approach is a more balanced alternative than the traditional PBC.

COMPARE AWARD TERM CONTRACTS WITH VARIABLE TERM CONTRACTS

Award Term contracts link the contract duration to the seller’s performance and award additional duration for consistently meeting or exceeding performance requirements.

Table 1 gives examples of criteria you could use to assess your Award Term contracts.

Table 1: Award Term Assessment Criteria

|

Core

|

Optional

|

- Explains general contract requirements for delivering buyer’s outcomes

- Produces positive seller behaviors

- Achieves performance measures

|

- If necessary, allow varying (changing) of contract pricing.

- If a remediation plan is required, or raised, it needs to be satisfactorily completed.

|

Using the Award Term assessment motivates sellers to maintain high levels of performance throughout the contract term, while buyers benefit from consistent performance. This benefit reduces administration costs by eliminating the need to re-tender.

Know the limitations of the Award Term model in high-investment contracts

1. Award Term contracts become significantly limited when they require large, upfront investments in infrastructure and equipment. If the initial term is relatively short – usually between 6 to 7 years – sellers are required to recover their significant investment within this period. This often results in inflated contract prices that could otherwise be spread out over a longer contract term – assuming the buyer would grant a contract extension.

2. Amortization challenges of recovering costs: Award Term contracts with short initial terms create financial pressure for sellers who must recover costs over a limited time. For example, a project that involves constructing a facility or investing in new infrastructure may involve costs that must be recouped over a 20-year period. However, if an initial term is only 6 to 7 years with no guaranteed extension, sellers may inflate their bids to cover the possibility of non-extension. But this would lead to high upfront costs.

3. Risk of performance-based extensions: Although the Award Term model incentivizes performance, it also introduces uncertainty for sellers who have made significant investments.

If sellers fail to meet performance requirements, they risk losing potential contract extensions and possibly paying large sunk costs (a past expense they cannot recover, regardless of future actions.) This risk often deters sellers from participating in high-investment projects unless they can guarantee cost recovery within the initial term. This too negatively impacts pricing and contract viability.

4. Misalignment with investment lifecycles: Infrastructure investments – particularly in sectors like defence, energy, transportation, and construction – often have lifecycles extending well beyond the short initial contract terms typical of Award Term contracts. The lack of alignment between the investment lifecycle and the contract term creates inefficiencies, because sellers face financial risks that discourage long-term capital investments.

Consider the Variable Term contract – it’s a flexible approach

To address these limitations, the Variable Term contract model offers an alternative allowing sellers to spread their costs over the full length of the contract while maintaining performance accountability. The Variable Term starts with the seller receiving the maximum term of the contract up front – such as 20 years – to allow the seller to amortize investments over this extended period.

However, unlike traditional long-term contracts, the Variable Term incorporates performance reviews like the Award Term approach, but it focuses on reducing, rather than extending, the contract term based on seller performance. If a seller fails to meet performance criteria, the contract term is reduced, and opportunities are provided to regain the loss with subsequent good performance.

Table 2 outlines the key features of a typical Variable Term contract.

Table 2: Key Features of a Variable Term Contract

|

Key Feature

|

Definition

|

|

Initial Term

|

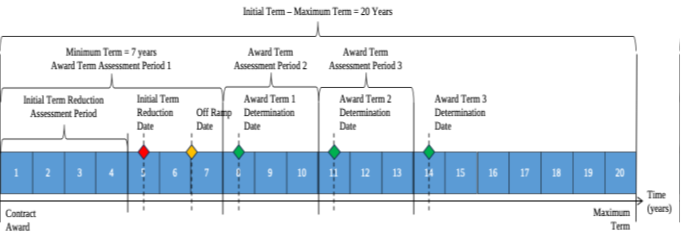

Unlike Award Term contracts, the Initial Term is equal to the Maximum Term. For example, Figure 1 (below) shows the Initial Term as equal to Maximum Term, or 20 years.

|

|

Minimum Term

|

Like Award Term contracts, a Minimum Term occurs when, due to contract non-performance, the contract would be terminated for default. Unlike Award Term contracts, the Contract Term on signature is the Initial Term, and not the Minimum Term.

|

|

Term Reduction Assessment

|

A Term Reduction Assessment reflects the assessment to reduce the Contract Term. It is typically conducted annually after an initial period, between 3 to 5 years. As shown in Figure 1 below, the Initial Term Reduction Assessment occurs 4 years after contract signature and then annually after this.

|

|

Award Term Assessment

|

Unlike the Term Reduction Assessment, the Award Term Assessment reflects the assessment to increase the Contract Term allowing recovery of the lost term through the Term Reduction Assessment.

It is conducted a few times during the contract, and only after the Minimum Term is completed. The example in Figure 1 shows that the Award Term Assessment is conducted at the end of years 7, 10, and 13.

|

|

Off-Ramp Date

|

The Off-Ramp Date allows the contract to be terminated or recompeted if unsatisfactory performance persists, and this termination or re-competing can range from elements of the contract scope to the entire contract scope.

|

The assessment process allows for both reducing and extending the contract term based on performance, offering flexibility to buyers and sellers.

The key features defined in Table 2 of our example Variable Term contract can be seen in Figure 1.

Figure 1: Variable Term Contract Key Characteristics

How do Variable Term contracts operate?

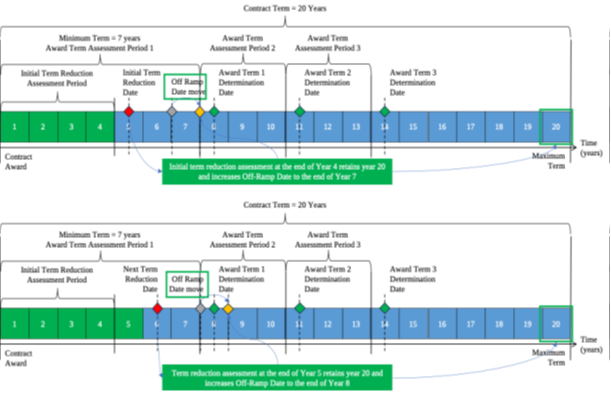

- Good Performance Scenario: The seller consistently meets or exceeds performance requirements, leading to no reductions in the contract term. The contract remains at the maximum 20-year duration, and the Off-Ramp date is extended. The seller enjoys stable operations, while the buyer benefits from high-quality performance.

Figure 2 illustrates Scenario 1.

Figure 2: Variable Term Contract Scenario 1 – Good Performance

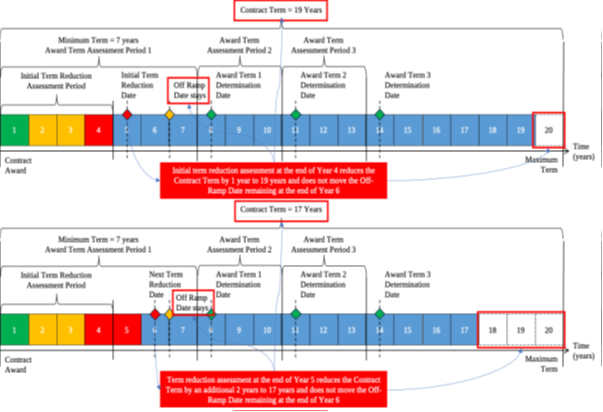

- Poor Performance Scenario: If the seller fails to meet the performance requirements, the contract term is reduced by between 1 to 3 years, depending on the severity of the performance issue. In subsequent years, if performance does not improve, further reductions may be applied. If the seller cannot rectify performance issues, the Off-Ramp option allows the buyer to terminate the contract and re-tender the scope of the contract.

Figure 3 illustrates Scenario 2.

Figure 3: Variable Term Contract Scenario 2 – Poor Performance

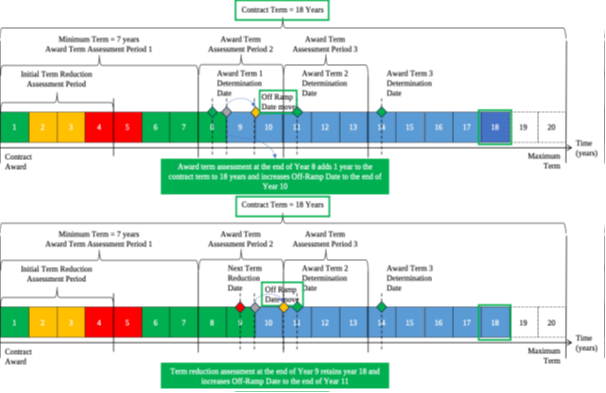

- Mixed performance scenario: The seller experiences early performance difficulties, leading to an initial reduction in contract term. However, after addressing these issues, the seller begins to meet performance requirements, resulting in the recovery of the lost contract term through the Award Term mechanism.

Figure 4 illustrates Scenario 3.

Figure 4: Variable Term Contract Scenario 3 – Mixed Performance

These scenarios demonstrate how the Variable Term contract provides flexibility and balances performance incentives with the need for long-term cost recovery for both buyer and seller.

While the Variable Term contract provides clear advantages over both traditional long-term contracts and Award Term contract models, it also introduces new challenges.

Advantages of the Variable Term approach

· Cost recovery: Sellers can amortize investments over a longer period, leading to lower initial contract prices.

· Performance accountability: The Variable Term model retains performance incentives through regular assessments and potential reductions in the contract term.

· Flexibility: Sellers have opportunities to recover lost contract duration if performance improves, mitigating the impact of early-stage performance issues.

Disadvantages of the Variable Term approach

· Complexity: Adjusting the contract term based on annual performance assessments can be administratively burdensome if you are involved with Contract Change Proposals (CCPs).

· Uncertainty: Sellers may face uncertainty regarding the final length of their contract, which can affect long-term planning and investment.

· Increased monitoring: The need for regular performance reviews adds an administrative burden for both parties.

In conclusion, Award Term contracts have proven effective in incentivizing seller performance but fall short when applied to contracts with the need for high investment requiring long-term cost recovery. The Variable Term contract offers a flexible alternative by providing sellers with the maximum term upfront while incorporating performance reviews that can reduce or extend the contract term based on seller performance. The Variable Term contract strikes a balance between allowing sellers to amortize their investments over a longer timeframe while ensuring continuous performance accountability for the buyer.

As contracts requiring high-investment in infrastructure and equipment become more commonplace, the Variable Term approach offers a promising solution to managing the financial and performance risks associated with these long-term, performance based contracting agreements.

ABOUT THE AUTHORS

Dr Andrew “Jacko” Jacopino is one of Australia’s best-known PBC practitioners and trainers, having been involved in over 100 domestic and international PBCs for both buyers and sellers since 2005. As a Fellow of World Commerce and Contracting (WorldCC) specializing in performance, collaboration, and governance he brings world class insight, skills, and practical experience in working with commercial arrangements from all industries and of all scopes and sizes.

Ngamuru Advisory, is an Australian small business formed in 2016 providing strategic advisory and commercial services to government agencies. Their focus is leveraging talented and experienced people to deliver practical, common-sense and effective advice and assistance to achieve great outcomes for government projects and policy initiatives.

Jeremy Chenier has 13 years of government contracting experience gained both in the public and private sectors. His most recent experience has in the development and implementation of a long-term aircrew training services contract incorporating a comprehensive performance management framework.

Public Services and Procurement Canada supports Canadian federal departments and agencies in their daily operations as their central purchasing agent, real property manager, treasurer, accountant, pay and pension administrator, integrity advisor, common service provider and linguistic authority.

Roger Chouinard has over 44 years of military and public servant experience as an Aerospace and Sustainment Engineer. While he participated in several corporate change initiatives over his career, he most recently led the successful development of a contemporary Performance Management Framework, including a Collaborative Management approach and a Continuous Improvement and Innovation program, for the Future Aircrew Training (FAcT) Program.

Future Aircrew Training (FAcT) Program will provide a relevant, flexible, responsive and effective ab initio aircrew training program for Pilot, Air Combat Systems Officer and Airborne Electronic Sensor Operators to meet future aerospace requirements of the Department of National Defence. The contract was awarded in 2024 and is planned to be fully operational in the early 2030s.