Should your company:

- Endow an African village with a gas-powered generator, or leave villagers in carbon-free darkness?

- Shun a supplier that has few female managers by European standards but a high percentage by local standards?

- Give the boot to a key supplier with a scandal-ridden CEO, or grant its Board time to right the ship?

Welcome to the world of sustainable procurement.

A global movement gains momentum

Sustainability has spread throughout global politics and commerce with the force and fervor of a religious awakening.

The recent 26th UN Climate Change Conference of the Parties (COP26) in Glasgow1 convened Heads of State and Government from the world’s largest economies. Addresses included a declaration by Elizabeth II of England that “Time for words has now moved to the time for action.”2

Activity there has been, if not action. A recent NAVEX Global survey found that 88% of publicly traded companies have sustainability initiatives in place, along with 79% of venture and private-equity-backed companies, and 67% of privately-owned firms.3

Procurement in the cross hairs: three challenges

For procurement, sustainability means that simply balancing supplier quality, cost, and timeliness won’t do. Corporate buyers must consider suppliers’ sustainability performance, typically measured across environmental, social, and governance (“ESG”) factors. This scrutiny extends beyond first-tier suppliers. Sustainability advocates, investors, stakeholders – and soon, regulators – demand that ESG analysis cover the entire the supply chain, including the suppliers’ owners.

Given these demands, how can procurement professionals deliver? What knowledge, skills and resources will these professionals need? How can they help their companies reap sustainability’s promise while avoiding its pitfalls?

Procurement officers and their general managers can start by addressing three challenges:

- Fitting sustainable procurement into the larger picture of corporate governance and compliance;

- Understanding what sustainability means for allocating, transferring, and managing risk; and

- Honing communications and crisis-management skills through simulations and war gaming among procurement, governmental affairs, and communications’ PR.

- Fitting sustainable procurement into the larger picture

Sustainability matters. Where a company balances shareholder-wealth creation with stakeholder welfare, sustainability represents a corporate end goal.

Another company, however, might seek the lone end goal of maximizing shareholder wealth. Even here, however, the company cannot chase profits heedless of reputational blowback. A widely disliked firm resembles a lame animal in the wild: predators will cull it and kill it. So, sustainability will also matter to shareholder-wealth maximizers because it drives goodwill, a key long-term asset for generating higher returns.

In sum, sustainability matters to both companies. But, not in the same way or for the same reasons. While these companies might temporarily travel along the same path, they head toward different destinations, which lie on opposite sides of a philosophical divide.

For procurement, these differences have practical consequences

Consequences of end goal versus means to an end.

A company that views sustainability as a means to the end goal of maximizing shareholder wealth will focus on reputation management. That company will pursue sustainability initiatives that are easier to measure, to manage, and to publicize. It may also more readily outsource aspects of sustainability such as assessing suppliers’ ESG performance. That’s because the company doesn’t seek to differentiate competitively on ESG. Moreover, the company values outsourcing’s potential for insulating the company from the reputational risks of a faulty assessment.

By contrast, a company that balances end goals faces tougher and more complex challenges. Such a company needs to balance sustainability against shareholder-value creation. But sustainability itself comprises environmental, social, and governance concerns. How should the company balance tradeoffs among E, S, and G? Think of the three dilemmas posed at the beginning of this article (e.g., the African village).

A second complication involves appearances versus results. Where sustainability is an end goal, the company should in theory care less about optics and more about substantive accomplishments. Imagine, for example, that the company must choose between: (1) a supplier with a sustainability score of 7; and (2) a supplier that currently scores a 3 but which -- if awarded the contract -- will have the resources to bring itself up to a 7. Choosing the latter will arguably do more for sustainability but require the company to defend its actions and lay out resources uplifting the supplier. Which supplier should the company choose?

Finally, where sustainability is an end goal, outsourcing requires greater care. Companies typically don’t outsource activities in which they seek competitive advantage. When such outsourcing does take place, such as in U.S. midwestern manufacturing, customers expend significant resources and effort to ensure suppliers do their jobs right.

- Allocating, transferring, and managing sustainability risk

U.S. Midwestern manufacturing has, in fact, much to teach us about sustainable-procurement risk.

Allocating vs transferring risk. Suppose that equipment manufacturer Caterpillar (based in Illinois) buys a $200 engine part from a small, specialized midwestern supplier. That $200 part goes into a $150,000 engine, which in turn goes into an $800,000 excavator.

Caterpillar knows that a faulty $200 part might ruin both engine and excavator, as well as injure operators and passersby. Should a batch of defective parts become part of finished goods sold to end users, the small supplier cannot possibly make Caterpillar whole. So, even if Caterpillar’s contract allocates manufacturing risk to the supplier, this risk cannot be transferred. Caterpillar remains on the hook. Product-liability insurance might soften the economic blow somewhat. But insurance indemnifies neither compliance penalties nor reputational harms.

Relevance to sustainable procurement. Sustainable Procurement risks increasingly resemble the manufacturing risks faced by Caterpillar and its peers: such risks can be allocated, but not transferred.

Why is this so? The media, the market, and regulators expect companies to take responsibility for the ESG behavior of suppliers and even suppliers’ major shareholders. Whatever the contracts say, the purchasing company (and its procurement professionals) remain on the hook. If something goes wrong with ESG somewhere up the supply chain, the company will face public scrutiny and condemnation, and may face lawsuits and investigations. Outsourcing ESG assessments might partially deflect the reputational blow; but, as noted above, insurance will cover neither compliance nor reputational losses.

What, then, to do? Start by looking at the risk-management tools and techniques of midwestern manufacturers, which have long operated in a comparable environment.

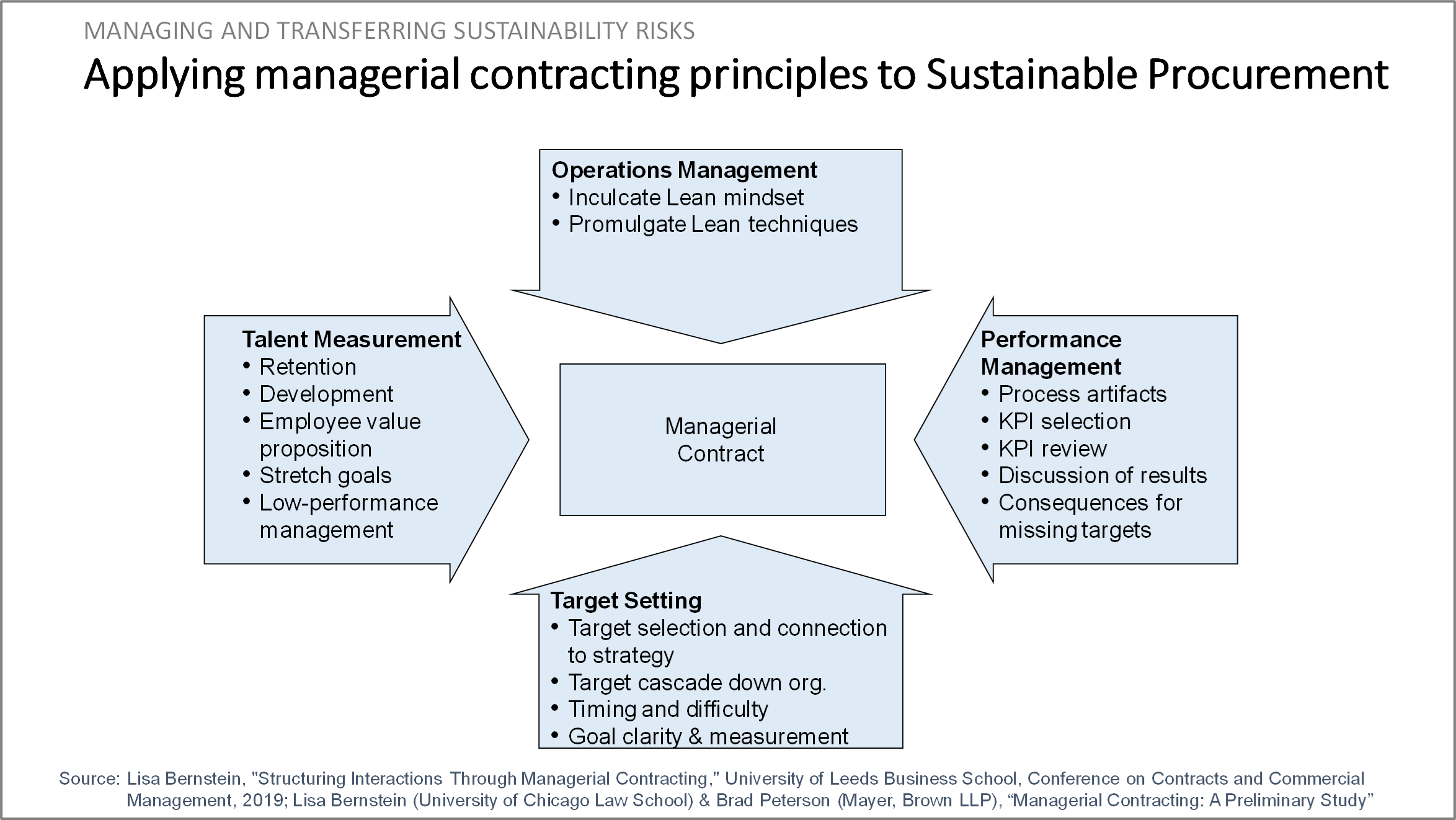

These tools and techniques fall under the rubric of “managerial contracting.”4 In managerial contracting, the purchaser influences and monitors suppliers’ operations management, performance management, target setting, and talent measurement.

The graphic below lists managerial contracting’s basic principles:

Situated somewhere between joint venture/partnership and transactional contracting, managerial contracting seeks symbiosis between customer and supplier. It develops the multi-tier transparency, coordination, and cooperation necessary to manage non-transferable manufacturing, compliance, and reputational risks.

Applying managerial techniques to sustainable procurement: Johnson Controls. Though domiciled in Ireland for tax purposes, Johnson Controls remains historically and culturally a U.S. midwestern manufacturer. It makes fire control, HVAC, and security equipment and systems for buildings. Revenues exceed $30 billion, with headcount of approximately 100,000 employees spread across 2,000 locations on six continents. The company has over 70,000 suppliers.5

Like Caterpillar, Johnson Controls cannot effectively transfer manufacturing, compliance, or reputational risk. It has therefore leveraged managerial contracting.

The company has, moreover, brought managerial contracting tools and techniques to its sustainable procurement function. For example, in setting priorities for and among E, S, and G, Johnson Controls conducted a Sustainability Materiality Assessment (“SMA”). The SMA comprised stakeholders, experts, supply-chain partners, and other interested parties. In consultation with these parties, Johnson Controls mapped potential initiatives based on importance to employees and to stakeholders.

This approach applied lean techniques from managerial contracting that look across the supply chain. They offered transparency. And, by working towards consensus, they encouraged cooperation and action. Such consensus also provided reputational cover through open and collective decision making.

Another managerial contracting technique Johnson Controls has applied to sustainability involves a sustainability council. The council comprises cohorts of suppliers and their tier-one suppliers; provides suppliers with training in sustainability best practices; and shares digital tools to meet public sustainability goals. The council thereby tackles sustainability challenges that can only be addressed across supply chain tiers, disseminates best practices, and creates peer pressure and praise among suppliers.

- Honing communications and crisis-management skills through simulations and war gaming

Managerial-contracting techniques like Johnson Controls’ mitigate and manage non-transferable sustainable procurement risks. But these risks cannot be eliminated. Nor, with regard to compliance and reputation, can they be insured.

This is not the end of the story, though.

Mitigating and managing compliance and reputational risks typically fall to a company’s governmental affairs and communications/PR functions.

Sustainable procurement risks require these functions to work hand-in-glove with procurement. Simultaneous engineering applies to sustainable procurement as much as to manufacturing. Collaboration needs to happen, though, well before problems arise.

Cross-functional crisis-management simulations and war gaming help. Showing previously siloed professionals how to work together often starts with convincing them of the need to work together. In this regard, nothing persuades like experiential learning.

On behalf of WorldCC, I recently led a crisis simulation for procurement professionals in a global financial-services firm. At the outset, one Vice President questioned the simulation’s purpose. After all, “Governmental Affairs and Communications handles this stuff.” However, after her mock press conference was derailed by colleagues pretending to be environmental activists, she warmed to the challenge. Working with other colleagues playing the role of an ESG-assessment vendor, this Vice President developed robust defenses of her company’s actions, anticipated lines of attack from activists, media, and regulators, and worked with the vendor to formulate joint strategies.

Experience is indeed the best teacher. Simulations and war gaming drive home lessons and spur collaboration and creativity like no other training. Given sustainable procurement’s non-transferable risks and cross-silo challenges, experiential learning should become a key part of sustainability training and development.

Hitting a Moving Target

Sustainability represents a moving target. In fact, broader ESG conversations have already begun over businesses’ relationships in general – not just with suppliers, but customers, distribution partners, alliances, etc.

So, companies must continually give chase and adjust their aim. For procurement, this starts with understanding how sustainability fits into the larger corporate picture, adapting risk-mitigation and management techniques from managerial contracting, and driving collaboration and innovation through simulations and war gaming.

Copyright © 2021, Robert Zafft. All rights reserved.

ABOUT THE AUTHOR

Robert Zafft, a WorldCC Fellow, is the author of The Right Way to Win: Making Business Ethics Work in the Real World. A Forbes Contributor in Leadership Strategy, he teaches Business Ethics at Olin Business School, Washington University in St. Louis, and provides, keynotes, corporate training, and leadership development for leading businesses around the world.

END NOTES

- UN Climate Change Conference UK 2021: Glascow COP26 31 Oct – 12 Nov 2021

- REUTERS: ‘Time for action” Queen Elizabeth tells climate change summit, William James

- NAVEX: Risk & compliance matters, Global Survey Finds Businesses Increasing ESG Commitments, Spending

- Lisa Bernstein, "Structuring Interactions Through Managerial Contracting," University of Leeds Business School, Conference on Contracts and Commercial Management, 2019; Lisa Bernstein (University of Chicago Law School) & Brad Peterson (Mayer, Brown LLP), “Managerial Contracting: A Preliminary Study”

- See Johnson Controls (GRI) 2021 Sustainability Report (https://www.johnsoncontrols.com/2021sustainability)